The ICC World Test Championship (WTC) Finals in June 2025 saw South Africa clinch their first ICC title in 27 years, beating Australia to win the World Test Championship (WTC) final 2025. The TAM Sports Advertising Report, analysing advertising trends across the WTC Finals of 2021, 2023, and 2025, revealed a dramatic contrast between the 2023 (India vs Australia) and 2025 (South Africa vs Australia) editions, underscoring the critical role of India’s participation in driving advertising volumes and the evolving landscape of advertiser preferences.

The 2025 Test Final played between Australia and South Africa observed a steep drop by 73% compared to 1st Test Championship

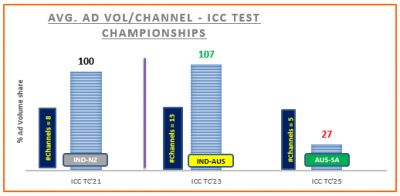

The 2023 final, held at The Oval, saw a robust 7% increase in television ad volumes compared to 2021, with an indexed ad volume of 107. This growth was driven by India’s participation, which attracted a massive viewership base and significant advertiser interest. The match was broadcast across 13 channels, reflecting strong media engagement.

In stark contrast, the 2025 final at Lord’s witnessed a staggering 75% decline in ad volumes compared to 2023, with the indexed ad volume plummeting to 26.6. The absence of India, coupled with diminishing interest in Test cricket and competition from other sports events like the IPL, led to reduced advertiser participation. The match was broadcast on only five channels, indicating a significant contraction in media coverage.

The report uses 2021 (India vs New Zealand) as the base year with an indexed ad volume of 100, providing a benchmark to measure growth or decline in subsequent finals.

Key findings:

Dramatic decline in advertising engagement in 2025

The most striking finding from the TAM Sports report is the 75% drop in ad volumes in 2025 compared to 2023, with the indexed ad volume falling from 107 to 26.6. This decline is attributed to several factors:

- India’s absence: India’s participation has historically been a major driver of advertising volumes due to its massive cricket fanbase and market size. The 2023 final, featuring India, benefited from this, while the 2025 final, with South Africa facing Australia, saw significantly reduced advertiser enthusiasm.

- Shrinking advertiser ecosystem: The number of advertising categories dropped by 70% (from 44 in 2023 to 13 in 2025), advertisers by 71% (from 49 to 14), and brands by 80% (from 70 to 14). This sharp reduction indicates a more concentrated and selective advertiser pool in 2025.

- Competition from IPL: The dominance of the Indian Premier League (IPL) in the sports advertising calendar has diverted marketing budgets away from Test cricket, particularly for non-India matches.

Shift in advertiser categories

The composition of advertising categories underwent a significant transformation between the two finals, reflecting evolving market trends:

• 2023 top categories: The 2023 final saw traditional sectors dominate, with perfumes/deodorants (10.3% share), cars (10.2%), cement (7.4%), two-wheelers (6.2%), and aerated soft drinks (5.2%) leading the charts. These categories align with India’s consumer goods market, leveraging the country’s massive viewership.

• 2025 top categories: In 2025, digital and service-oriented sectors took precedence, with Ecom-media/entertainment/social media leading at 22.8%, followed by energy drinks (13.2%), Ecom-financial services (12.9%), laptops/notebooks (12.1%), and Computer education (9.5%). This shift highlights the growing influence of digital-first brands and services, likely driven by younger audiences and changing media consumption patterns.

• The top five categories in 2023 contributed 38% of total ad volumes, while in 2025, they accounted for nearly 70%, indicating a more concentrated spend among fewer categories.

Despite the steep decline in ad volumes, the 2025 WTC Final is the highest-rated and most-watched non-India Test match on television. It clocked 2.94 billion viewing minutes and reached 47 million viewers on the Star Sports network, with digital engagement soaring to 225 million views across platforms. This paradox highlights a disconnect: while viewership remained strong, advertisers were less willing to invest without India’s presence, possibly due to perceived lower ROI in non-India markets.

.jpg)