Ad volumes on three out of four major media platforms - television, print, and digital - witnessed a marginal dip, with only radio witnessing a stable growth of 2%, indicating a shift in retail advertising strategy. These findings are from the latest TAM adEx 2024 report for the retail sector, which highlights a contrast to the aggressive growth patterns seen in 2023, despite overall ad volumes and impressions remaining at high levels.

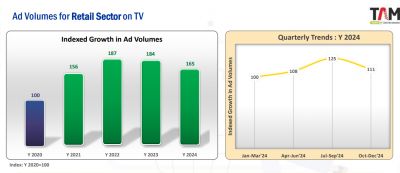

Television

Television showed a 10% decline in 2024 ad volumes compared to 2023. On a quarterly basis, however, indexed growth reflected continued momentum for 2024, with Q2, Q3, and Q4 registering gains of 8%, 25%, and 11% respectively over Q1.

Despite the dip, TV remained a powerful medium. News channels (49%) and GECs (26%) topped the genre chart, and Prime Time accounted for 36% of airplay. Electronics and fashion retail outlets continued to dominate categories, with Vasanth & Co, Reliance Retail, and Sathya Agencies leading the advertiser pack.

The top five categories collectively accounted for 97% of TV ad volumes. Among the top 10 advertises, Infiniti Retail and Myg India were the only new entrants in 2024 over 2023.

Print marked a de-growth of 5% in 2024 ad space, when compared to 2023. The quarterly trends for the sector in 2024 showed a decline of 9% in Q2 and 11% in Q3 compared to Q1. However, Q4 made a dramatic comeback with a 49% surge over Q1, underscoring the medium’s role in festive season and hyperlocal promotion cycles.

South India remained the epicenter, commanding a dominant 50% share of print ad space, and Hindi publications led linguistically with 26% share.

In categories, electronics and durables retail outlets secured top position with 44% share of ad space. The top 10 categories together added 98% share of ad space. Retail outlets-industrial/B2B was the only new entrant for the sector categories in the year on Print compared to 2023.

Among the advertisers, Reliance Retail and Vishal Mega Mart remained consistent top spenders on the medium, while Smart Bazaar made a notable leap into the top four.

The top 10 advertisers had 38% share of ad space.

Radio

Unlike its other traditional media counterparts, radio posted a marginal growth over 2023, showing that the medium continues to offer value in tier 2 and 3 markets, particularly for fashion and electronics brands.

Maharashtra, Kerala, and Tamil Nadu were the leading geographies, together contributing nearly half of all retail ad volumes on radio. On the brand front, Alishan and Dava India led the charts, while Reliance Retail once again featured among the top advertisers, underlining its cross-media dominance.

Digital

In a surprising shift, digital ad impressions for retail dipped in 2024 versus 2023, despite the sector having grown exponentially since 2020.

Home/Interiors (39%) and Department Stores (18%) were the top categories in the medium, marking a change from the electronics and fashion-heavy spends in other media.

Ikea Services (India) led the digital charge, accounting for 30% of total ad impressions, followed by Fabindia and Croma.

The medium saw advertisers prioritising programmatic buys with a 78% share, reflecting continued tech-driven ad delivery preference.

Conclusion

The slightly lower ad volumes on TV, print, and digital being accompanied by seasonal rebounds, and new advertiser entries, reveals a year of strategic recalibration across media in retail advertising, according to the TAM report. Despite minor year-on-year dips in mainstream media, overall momentum and quarterly rebounds underscore the retail sector’s resilience.

.jpg)