On 5 December, WPP Media and Meta launched the CPAS (Collaborative Performance Advertising Solutions) playbook for retail and quick commerce in India.

The playbook aimed to outline how consumer journeys are shifting from planned baskets to instant, inspiration-led purchases, and what that means for brands, platforms, and investors.

As part of the launch, two panels brought together leaders who live inside the quick commerce ecosystem every day. The second discussion looked ahead: what will it take to sustain this growth, make the model profitable, and unlock the next wave of categories and consumers?

Moderated by Karthik Shankar, head – digital investments, WPP Media, the panel comprised Meghna Apparao, director, e-commerce and retail, Meta; Divya Gupta, principal, Sharrp Ventures; and Nithya Ravi, associate vice president, global media, Godrej Consumer Products.

Kicking off the conversation, Apparao underlined how deeply quick commerce has embedded itself into daily life and why technology will define the next phase.

She said, “Twelve to eighteen months ago, we were asking – is this a trend or a fad? Today, as a consumer, I cannot imagine life without it. I’m stressed about packing for a family wedding abroad. If it were in Mumbai, I’d relax, as quick commerce would sort everything out. It has become core to how we live.”

The category basket has exploded. From simple grocery top-ups, consumers now order anything literally under the sun in minutes.

The next surge is pure tech plumbing

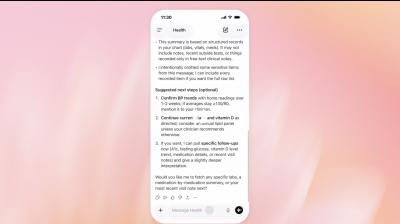

Apparao emphasised that future growth hinges on data flowing seamlessly between brands, platforms and Meta. “The magic happens when all three parties marry their signals. A South Indian area like Matunga (in Mumbai) sells far more idli-dosa batter than South Bombay. Brands know this, platforms know this, and Meta knows consumer intent from the content people engage with. Our Conversion APIs exchange those signals so the right product reaches the right person at the right moment.”

She added that explicit data points (birthdays, weddings) are less important than behavioural signals. “Instagram already knows you’re attending a wedding because you’re clicking wedding content. Tech just needs to let those signals travel," Apparao expressed.

Investor lens: infra build-out is just beginning

Divya Gupta split the opportunity into two buckets – infrastructure and technology.

On infrastructure: “Dark-store penetration can still grow 6- 7x, mostly in tier-2/3 towns. Logistics cost reduction via EVs, automation inside dark stores to lower fixed costs – the pipeline of infra deals is massive.”

On technology: “The biggest money being left on the table today is stock-outs. Better demand forecasting powered by AI is the immediate gap that will unlock huge value.”

Making the ecosystem talk in real time

Ravi, stressing interoperability, shared, “Depth of dark stores and inventory is table stakes. The real unlock is when off-platform and on-platform worlds speak to each other seamlessly and at scale. Collaborative ads on Meta already do some of this, but getting quick-commerce inventory, pricing and availability to influence media and vice-versa in real time – that’s the next joy for brands.”

The consumer has voted: I want it now!

Apparao predicted the death of the distinction between “traditional” e-commerce and quick commerce.

“Next year, there will be no ‘traditional’ players left sitting separately – Flipkart Minutes, Amazon Now, Myntra Now, Nykaa Now, everyone is racing to deliver in minutes. The consumer has decided: I want everything, and I want it now," remarked Apparao.

Three growth vectors remain:

1. Acquiring new-to-platform customers

2. Expanding category purchase (earbuds to clothes to gifts)

3. Penetrating tier-2/3 towns

Apparao said, “Collaborative ads are the profit engine for both brands and platforms because they collapse the funnel and drive relevant, high-intent traffic straight to available inventory.”

Why investors are obsessed with collab ads and quick commerce links

Gupta confirmed the frenzy, saying, “In the last week alone, three founders asked me to connect them to Meta for quick-commerce collab ads. Investors love improving ROAS (return on ad spend), and these formats are delivering it in small cohorts already. Higher Average Order Value (AOV), more non-grocery (higher-margin) purchases – it’s a flywheel everyone wants to accelerate.”

The category explosion: fashion, frozen foods, gifting

Apparao admitted she was previously skeptical about fashion and beauty on quick commerce. She shared, “I would have bet the least on it because of the long-tail stock keeping unit and sizing. But fast fashion is a consumer mega-trend, occasions are multiplying, and Instagram keeps those products top-of-mind. Margins are high, AOV jumps – it’s going to explode. The only question is the operating model for returns and selection.”

Gupta categorised the winners: High-impulse (instant gratification), high-urgency (can’t wait) and categories that were earlier constrained by cold-chain/distribution (e.g., frozen foods).

She flagged frozen foods and high-gratification categories (fast fashion, home décor) as the most exciting.

Ravi pointed to frozen goods, home care, and gifting as use cases already scaling, driven by sudden needs and last-minute purchase occasions.

In short, all three panellists agreed: the Indian consumer has irreversibly shifted to 'want it now'. The winners will be those who build the infrastructure, master the technology plumbing, and make every part of the ecosystem talk to each other instantly – all while riding the wave into fashion, frozen, gifting and beyond.

.jpg)