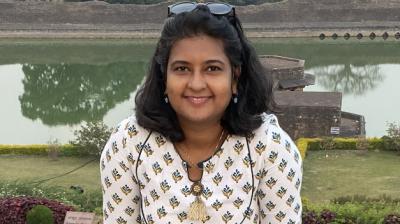

India is one of the world's fastest-growing insurance markets. Despite this, the penetration of insurance products in the country remains abysmally low - at less than four percent of the population. In an in-depth conversation with Manifest, Sheena Kapoor, head – marketing, corporate communications, and CSR at ICICI Lombard, decodes the reasons behind the dismal numbers in a sector that’s notoriously tough to crack. She also sheds light on dismantling barriers to insurance adoption, leveraging digital storytelling and gamification, understanding women’s role in financial decision-making, and more.

Insurance, unlike most products, is a category that rests on an invisible foundation of trust. “An insurance policy inherently rests on a principle of trust,” says Kapoor. “Unlike most transactions, here the consumer pays first with the belief that the brand will stand by them when the need arises.”

Cracking the low-engagement code

It’s a high-bar proposition in a country where insurance penetration remains under four percent. “While India is one of the fastest-growing insurance markets globally and is expected to become the sixth-largest in the next five to six years, our penetration levels remain dismally low,” Kapoor notes.

Even in mandatory segments like motor insurance, the numbers are not where they should be, she points out, noting that it comes down to multiple barriers.

The first factor, according to Kapoor, is a lack of awareness. “Though that has improved post-pandemic, especially around health insurance,” she admits. “But the deeper issue is perception - many still see insurance as an unnecessary expense rather than as ‘a must have’ to tide over unforeseen circumstances.”

Yet, even with the improved awareness around health coverage, gaps remain. “A lot of consumers don’t realise that OPD (Outpatient Department) consultations, diagnostics, and scans are covered under policies,” she says. “Many still think insurance only kicks in after hospitalisation.”

Simplifying the complex

ICICI Lombard’s strategy to simplify and humanise insurance rests on three pillars: category advocacy, product innovation, and digital accessibility.

“As an industry, we’re collectively building advocacy through campaigns like ‘Achha Kiya Insurance Liya’ - aimed at demystifying insurance across health, motor, SME, and travel,” says Kapoor, drawing a parallel with the mutual fund industry’s now-iconic ‘Mutual funds Sahi Hai’ campaign.

At the same time, regulatory moves are helping shift the narrative. “The IRDAI’s (Insurance Regulatory and Development Authority of India) initiatives like Bima Sugam and Bima Trinity are transforming distribution and access. Removing GST on health and travel insurance has also made products more affordable,” Kapoor explains.

ICICI Lombard, for its part, is tackling complexity through micro-insurance and sachet-based products by creating seamless touchpoints - customers can now get on-the-spot digital cover via its app or even WhatsApp. “Behavioural change takes time, but post-Covid, people recognise that even a routine doctor’s visit can cost thousands. Insurance brings peace of mind,” she says.

The evolving demographic

While men still dominate financial decision-making in many households, Kapoor sees a steady shift. “Women are increasingly the primary influencers, especially as they become more financially independent and aware.” There’s growing interest in maternity and women’s health products, as well as travel insurance - where women often play a major role in planning family trips.

Yet, the brand’s approach remains inclusive, says Kapoor. “We are conscious of keeping our communication gender-neutral. Our narratives are inclusive rather than spotlighting one gender,” she adds.

Reaching younger, digital-native audiences is an altogether different proposition, which the insurer tackled in a language they understood best - gaming.

ICICI Lombard’s ‘Game of Life’ campaign used gamification to simplify insurance through playful storytelling. “It’s not about trivialising,” Kapoor clarifies. “It’s about making a complex subject engaging, fun, and easy to relate to.”

The campaign drew parallels between gaming challenges and life’s unpredictability - complete with energy bars, avatars, and a protagonist shielded by an 'insurance power-up.' “The message remains serious; only the delivery is different,” she says.

The result? The campaign went viral organically, with influencers and users recreating the ‘hook step’ across social platforms, according to Kapoor.

The brand also found an inventive way to bring the brand into public consciousness - by branding the Siddhivinayak metro station in Mumbai, located near ICICI Lombard’s headquarters. “The synergy was natural,” she says. “Lord Ganesha is seen as the remover of obstacles - which aligns beautifully with our category.”

However, in a category where every claim tests credibility and with ‘trust’ as the ultimate KPI, Kapoor believes the real brand-building happens after the sale. “We can create the best campaigns out there, but if we don’t honour our claims, it all falls flat. Because that’s really where the proof of the pudding lies - whether one can really walk the talk."

Read the full chat with Kapoor in our November issue. Click here to get your copy!

.jpg)