Global advertising spends in 2025 are set to see a growth of 8.9%, according to a report by Warc.

In September, the estimate was that ad spends were to grow by 7.4% in the year. The increase in spends comes on the back of strong results from the big tech platforms and a muted impact on global trade from trade tariffs, according to the report.

Next year's growth is slated to be 9.1%, while 2027's growth is scheduled to be 7.9%.

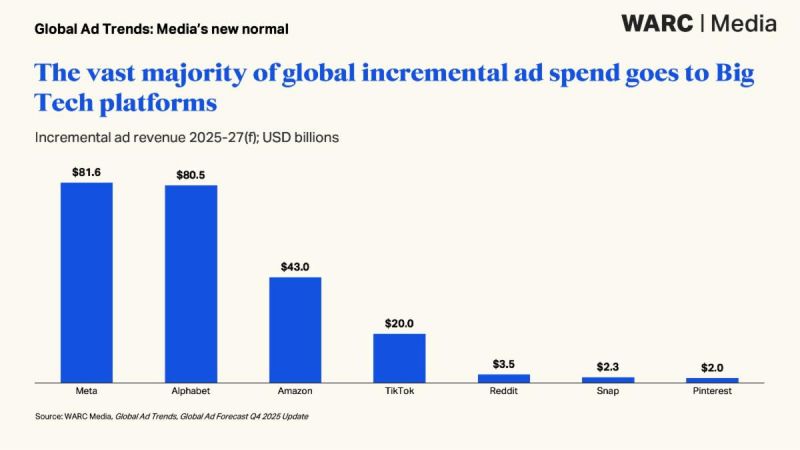

The latest forecasts show that the benefits of strong global growth prospects will not be evenly distributed. Alphabet, Meta and Amazon will collectively absorb the vast majority of incremental global ad spend between 2025 and 2027, increasing their share of the global ad market excluding China to 58.8% by the end of 2027. Their share at the end of this year is 56.1%.

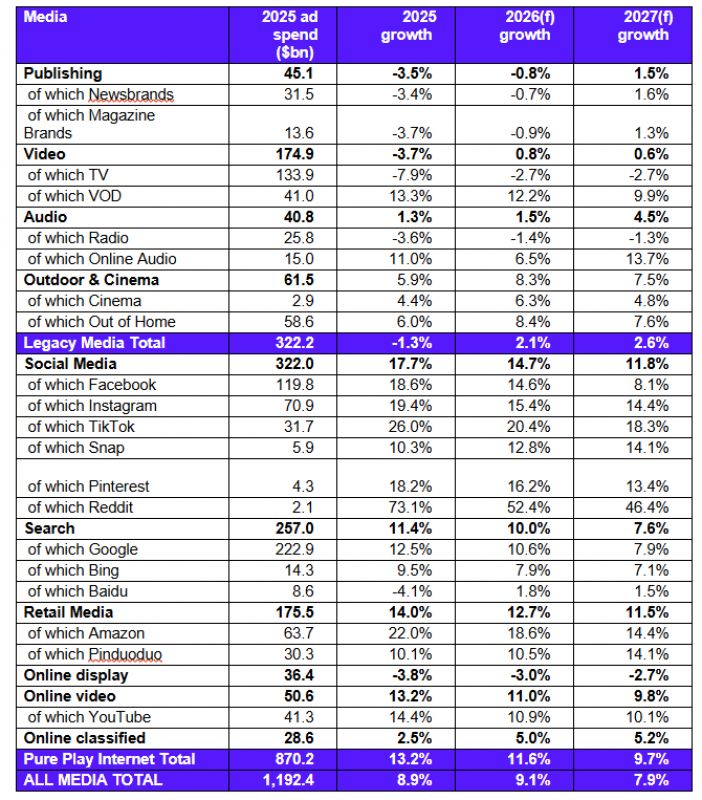

Overall, legacy media (publishing, TV, audio, outdoor and cinema) is estimated to de-grow by 1.3% this year, however it will grow by 2.1% in 2026 and 2.6% in 2027.

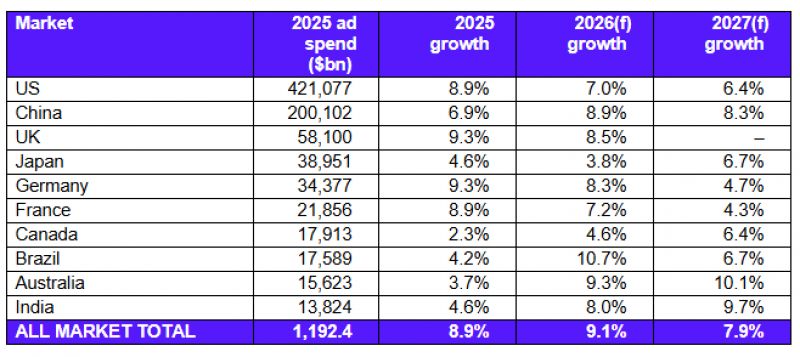

The US, as the largest advertising market globally, accounts for 35.3% of the global total, equating to USD 421.1 billion in spend and a rise of 8.9% this year. The US ad market is set to grow by a further 7% next year, buoyed by the men’s FIFA World Cup and midterms, while a rise of 6.4% is forecast for 2027, pushing the market total to USD 479.4 billion.

China, the second-largest advertising market, is forecast growth of 6.9% in ad spend to USD 200.1 billion this year (16.8% of the global total). Growth is expected to accelerate to 8.9% in 2026 and 8.3% in 2027.

The UK overtook Japan in 2022 to become the third-largest ad market globally. It is now valued at USD 58.1 billion with anticipated growth of 9.3% in 2025.

Canada and Mexico are also set to benefit from hosting games during the men’s FIFA World Cup next year. The Canadian ad market is set to end 2025 with growth of 2.3% to USD 17.9 billion, with rises of 4.6% and 6.4% forecast for 2026 and 2027, respectively. Mexico’s ad market is expected to contract by 8.8% this year (to USD 7.5 billion), before returning to growth next year (6.6%) and into 2027 (7.2%).

Elsewhere, India is on course to see a 4.6% rise in ad spend this year, to USD 13.8 billion. Next year's growth will accelerate to 8% in 2026 and 9.7% in 2027.

Brazil is also poised to record fast growth over the forecast period, rising 10.7% in 2026 due in part to the FIFA World Cup being broadcast in a favourable time zone.

.jpg)