COMvergence has released its new business barometer report for the first half of the year. The independent research bureau analyses media spend investments and produces benchmark studies on new business performances, and billings and market shares of media agencies.

The list which includes retention is led by EssenceMediacom (new business value of USD 217 million), Starcom (new business value of USD 70 million), followed by Havas Media (new business value of +22 million).

| NEW BUSINESS WINS (INCLUDING RETENTION) | |

| EssenceMediacom | USD 217 million |

| Starcom | USD 70 million |

| Havas Media | USD 22 million |

| Mindshare | USD 14 million |

| PHD | USD 14 million |

Godrej Group, Hero Motocorp, Dabur, Mars, LinkedIn and Suzuki Motorcycles were among some of the account moves that dominated the Indian market from January 2025 to June 2025.

WPP Media (new business value USD 242 million), Publicis Media (new business value USD 76 million) and Omnicom Media Group (new business value USD 30 million) respectively led the media agency groups.

Among the 73 moves and retention with media spends estimated to be USD 605M assessed by COMvergence in the Indian market for this period, only 11 were global and multi-market pitches with a new business value of USD 61 million. 62 account moves and pitches with a new business value of USD 544 million were all local in nature.

This places India far above the global average of local pitches (which were at 61%) whereas India saw 98% of the total pitches being local in nature (country specific pitches).

In H1 2025 (January 2025 to June 2025), COMvergence assessed more than 1,840 media account moves and retentions (1,195 advertisers in total) across 49 countries totaling USD 17.6B (+7% vs. H1 2024). The US represented 45% of the total spend reviewed globally, while China accounted for another 11%.

| APAC OVERVIEW | |

| Top Media Agencies | |

| Zenith | USD 30 million |

| Wavemaker | USD 225 million |

| Starcom | USD 214 million |

| Spark Foundry | 179 million |

| OMD | 112 million |

Publicis Media (new business value USD 1,366 million), Dentsu (new business value USD 282 million) and Omnicom Media Group (new business value USD 198 million) respectively led the media agency groups.

Mars, Pepsico, Godrej Group, Mercedes Benz Group, Honor, Shanghai General Motors, Hero Motocorp, Kimberly Clark, Disney Park and Resorts, were among some of the account moves that dominated the Asia Pacific market during the first half of the year.

Global

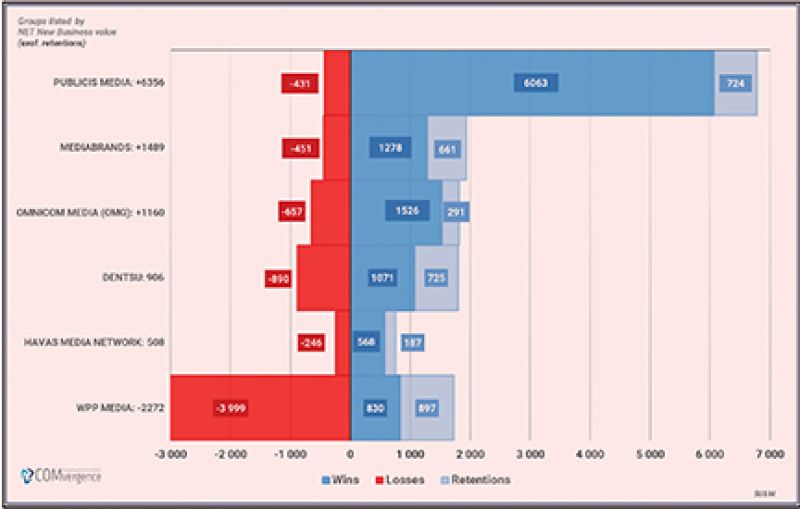

Publicis Media led both total and net new business results, generating USD 6 billion in new client billings, including Coca-Cola (USD 835 million) in North America and eight global accounts: Barilla, Dropbox, Goodyear, LinkedIn, Mars, Paramount, PayPal, and Santander.

Mediabrands ranked second with USD 1.5 billion. OMG completed the top three, supported by global consolidated wins such as Kimberly-Clark (ex-North America), Zurich Insurance, and multiple US gains.

WPP Media was the only one among the big six groups to post a negative result, both including and excluding retentions.

In H1 2025, COMvergence assessed nearly 1,840 media account moves and retentions across 49 countries, involving 1,195 advertisers and totaling USD 17.6 billion (+7% vs. H1 2024). The US represented 45% of the total spend reviewed globally, while China accounted for another 11%.

Local reviews made up 61% of the total spend (USD 10.7 billion), while global and multi-country reviews reached USD 6.9 (billion).

The overall retention rate was just 19%, the lowest in eight years. Publicis Media achieved the strongest retention rate (63%) at the group level. In contrast, WPP Media retained only 18% of its USD 4.9 billion in billings under review.

Independent agencies captured USD 2.9 billion (16%) of total spend reviewed. To be noted that Accenture Song has won its first sizable media account in Australia (Optus, USD 45 million).

This data was first published in Manifest's October issue. Buy a copy here!

.jpg)