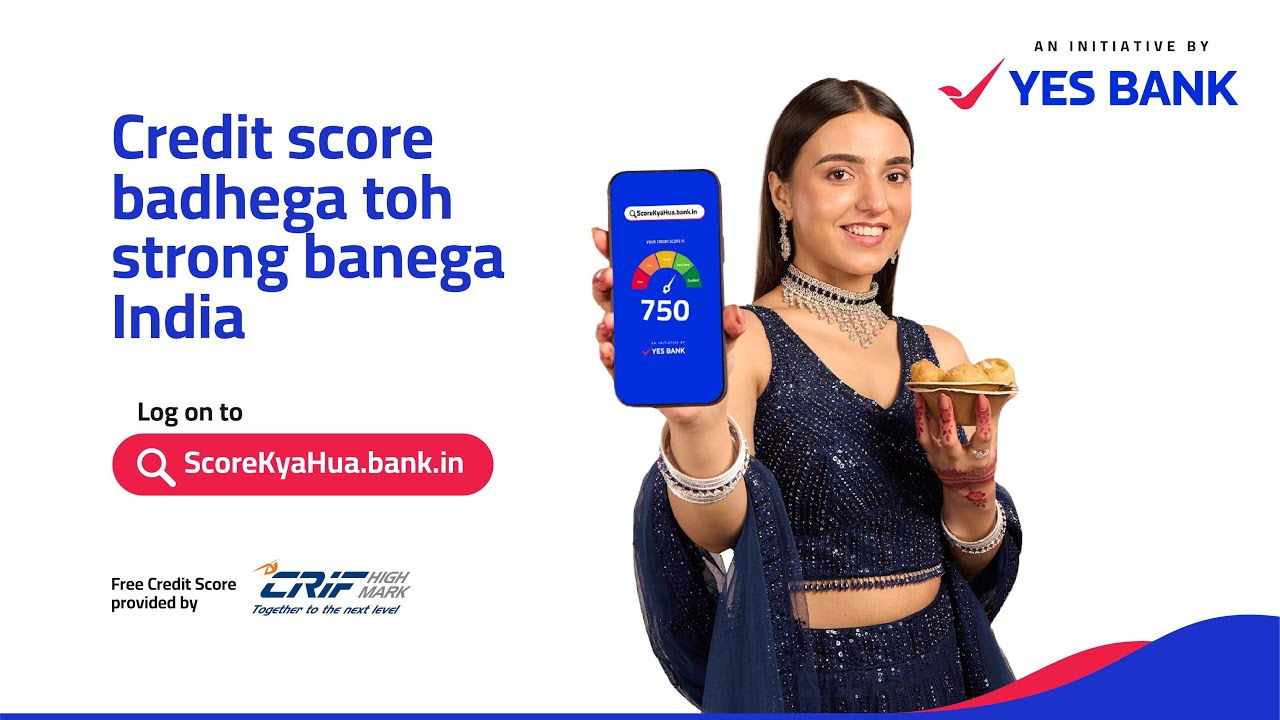

Yes Bank has launched 'Score Kya Hua' (What’s the score?), a nationwide CSR initiative to bring credit score awareness to every Indian, recognising a critical knowledge gap.

To demystify credit score, the brand has created four slice-of-life ad films that embed financial education in everyday scenarios.

At the heart of the campaign is ScoreKyaHua.bank.in, a microsite powered by CRIF High Mark, as knowledge partner. It offers free credit score checks and easy-to-understand educational content designed for India's diverse credit landscape. For first-time credit seekers, the microsite offers step-by-step guidance on building a credit profile. Similarly, for existing borrowers, whether applying for a personal loan, car loan, or home loan, the platform helps them understand how everyday financial behaviours impact their credit scores.

The microsite features curated blogs, informational videos, myth-busters that address common misconceptions about credit scores, and an interactive credit simulator that lets users see how different financial decisions might impact their scores.

What we think about it: The campaign takes a subject that is usually intimidating, technical, and often avoided, and reframes it through familiar, slice-of-life moments, thus effectively lowering the psychological barrier that often surrounds conversations about credit health. The message lands by humanising the topic and grounding it in everyday humour and relatable situations.

Prashant Kumar, managing director and CEO, Yes Bank, said, “We believe that true financial inclusion goes beyond access to credit—it also requires the knowledge to manage it wisely. Yes Bank, through its ‘Score Kya Hua’ CSR initiative, is driving a national movement to help every Indian understand what a credit score means and how to improve it. Our aim is to address the existing knowledge gap and expand the pool of creditworthy individuals by promoting responsible credit behaviour. We are trying to contribute towards building a financially confident Bharat by empowering people with the right knowledge and tools to shape their financial future.”

Sachin Seth, chairman, CRIF High Mark, regional managing director, CRIF India and South Asia said, “We are excited to join hands with Yes Bank as the knowledge partner for 'Score Kya Hua' by providing CRIF Credit Score. At CRIF, promoting and nurturing credit awareness is central to our mission because understanding credit and its impact is key to building strong, lasting financial journeys in addition to driving financial inclusion for the economically weaker sections. We aim to share practical insights and tools that enable everyone to take charge of their credit journey with clarity and confidence.”

.jpg)