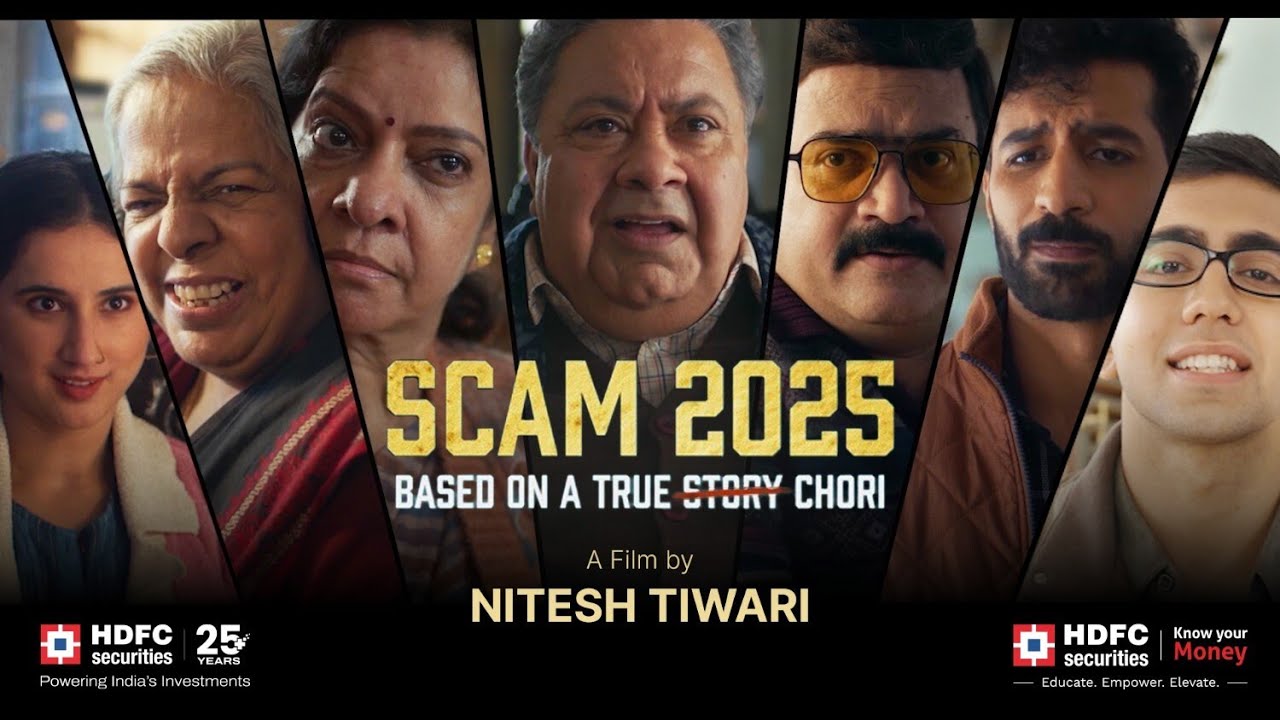

HDFC Securities has rolled out a campaign for its latest initiative, 'Kya Aap Taiyyar Ho?' (Are you ready?), which is a nationwide fraud awareness movement under its #KnowYourMoney program. It features actors Manoj Pahwa, Bhuvan Arora, Sapna Sand, Shrikant Verma, Nutan Surya, Simran Shah, and Siddhant. The narrative employs humour and recognisability in converting awareness into action.

The campaign for this cause is conceptualised by The Script Room and is directed by Nitesh Tiwari. It consists of a five-part mini-series, out of which two parts have been released.

The series brings to life a witty yet hard-hitting ‘Fraudster Family’ to show how scams actually work, from emotional manipulation to online trickery. Through each film, the inner mechanisms behind the latest frauds, from emotional manipulation to online trickery, are revealed, prompting reflection and caution in the audience.

In the first film (above), Arora, who plays the son, tells his father (Pahwa) that he doesn’t want to continue the family business. The announcement shocks everyone, sparking a round of disapproving comments. Pahwa reminds him that being thieves has been their family tradition, “We’re born thieves, not lazy ones.” That’s when the family starts discussing how times have changed. Earlier, they broke into homes; now, they slide into DMs. They talk about switching to online scams, promising fake investment returns and planning a 'modern' makeover. The film closes with a reminder that thieves have simply evolved, urging viewers to stay alert and invest wisely.

In the second film (below), Pahwa is seen teaching a 'class' on how to scam people, with his entire family as eager students. They rehearse mock calls, practice their lines, and fine-tune their bluffing tactics to sound convincing. The film ends with a warning that scammers are getting smarter and more prepared than ever. It urges viewers to stay cautious and remember that no matter how tempting an offer sounds, it’s always better to verify before believing.

What we think about it: The films have smartly used humour and everyday relatability to make a subject like financial fraud feel engaging and memorable. While the setup occasionally borders on theatrical, the storytelling grounds it with warmth and purpose, turning awareness into something watchable rather than preachy.

Puneeth Bekal, EVP and CMO, HDFC Securities, said, “Investment fraud has evolved in scale and sophistication, and the only sustainable defence is awareness. Through #KnowYourMoney and ‘Kya Aap Taiyyar Ho?’, we are creating a movement that enables Indians not only to secure their money but also to take well-informed financial decisions. The campaign leverages the power of entertainment in sparking learning and curiosity and putting the power of prevention in people’s own hands. Staying true to our 25-year legacy, this is an ongoing effort to guide our investors to invest responsibly. This is not just a campaign; it's a movement toward economic security.”

Ayyappan Raj, co-founder, The Script Room, added, “The concept of scamming seems like it was created by some computers and machines on the Internet. It’s not, it’s just a bunch of people who do it. The campaign idea was to humanise investment scams, making everyone relate to it and understand it, and therefore be aware of it in everyday life. In terms of treatment, we stayed away from the trending, quirky zone of advertising and chose a classic form of storytelling. Big thanks to Nitesh Tiwari and the team at EarthSky for making these scripts land so brilliantly and charmingly. Big hugs to the team at HDFC Securities for being great clients and collaborators.”

Tiwari said, "When you see families losing their hard-earned savings to fraud, you realise awareness isn’t optional. It’s essential. Through our association with HDFC Securities’ #KnowYourMoney initiative, we’re using storytelling to help India escape the traps of investment fraud. This campaign is about empowering every investor to stay informed, stay ahead of the curve, and protect what they’ve built. Because in a fast-moving financial world, knowledge is the real safety net.”

.jpg)